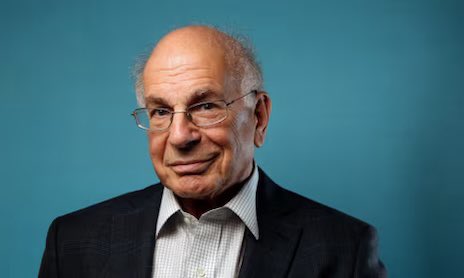

One of the finest and celebrated psychologists of the present time, Daniel Kahneman, took his last breath on 27th March, 2024 at 90 years of age. He has been one of my favourite academics from the discipline of psychology who brought clarity in my thinking on the theories that looked difficult to understand. He was one of the most influential psychologists of the 20th century.

He was of Jewish origin born in Tel Aviv and was an American citizen, teaching at Princeton University, when he died. The 2nd world war hit his family hard and left him with many experiences. One of them was a lesson from his mother that people are endlessly complicated and interesting. Perhaps that was the force for him to take up human psychology as a discipline of higher studies.

His understanding of economic behaviour and decision making has influenced many scholars to explore applications of theories across disciplines. The recognition of his contribution on the irrational behaviour (conditions when no rationality exists) of investors in the stock market won him Nobel Prize for economic sciences in the year 2002. No study in the field of behavioural finance is complete in absence of citing the contributions made by Daniel Kahneman. His work on heuristics and biases with his close associate Amos Tversky led to many classic contributions in the field of behavioural finance. They are the torch bearers of Prospect Theory that is widely acknowledged and cited across disciplines and geographies. In our work on Behavioural Finance exploring different kinds of biases as prevalent among investors across nations, their evidences have been of immense help.

He articulated the conditions in which thinking fast (system 1) is preferred over thinking slow (system 2). However, at times situations also demand thinking slow over thinking fast to aid communication with conviction and clarity. Through experiments and experiences, he produced excellent body of literature on defending thinking fast as well as thinking slow. His work on decision making at different levels has garnered immense respect. (for detailed review of Thinking Fast and Slow by Kahneman click here)

He was one of the prominent thinkers who believed that happiness can be measured. He developed a measurement tool to assess happiness known as Day Reconstruction Method or DRM based on the responses of the individuals through their remembering self and experiencing self. This tool has been used by many scholars in different regions of the world including China. Kahneman believed that it is more important to reduce miseries rather than improving happiness. His work surrounded hedonism. He echoed the message of Indian scriptures that it is easier to recognize other people’s mistakes than our own.

In 2021 he authored another bestseller Noise – a flaw in human judgement (coauthors – Olivier Sibony and Cass R Sunstein) building a strong case on biases and predictableness of the judgements. When there is noise, the judgements are unclear and unpredictable. They suggest to take the presence of noise seriously to make effective decisions.

Daniel Kahneman has been an institution in himself inspiring scholars across regions and cultures to keep exploring different dimensions of human behaviour. His guidance on some of my follow-up studies on quality of life and happiness have been of much help to me. He was appreciative of the work leading to find variables of happiness. I shall miss his guidance.

He has left a rich legacy of unforgettable work that would guide many generations of scholars. For sure he shall be missed across disciplines and geographies.

10 thoughts on “DANIEL KAHNEMAN – AN OBITUARY”

Psychology is an important field to understand the human nature and behaviour

Thanks for the enriching take.

Surely we will miss him, one of the life lesson that I learned from him is reflecting in his famous quote….”We are prone to blame decision makers for good decisions that worked out badly and to give them too little credit for successful moves that appear obvious only after the fact”

Extremely sorry to know this.

It’s a huge Irreparable loss.

May God rest his soul in everlasting peace.

Definitely he has a big contribution with Amos Tversky in the field of Behavioral finance, Prospect theory which was given by him in 1979 is the milestone in the field of Behavioral finance, Kahneman and Tversky have published a series of article and defined the Heuristic and Biases. The assumptions of Conventional finance and investor rationality and market efficiency are challenged by Kahneman and Tversky time to time.

We are immensely benefitted by his contribution on various dimensions of human psychology.May His soul attain eternal peace.

If we want to understand Finance and Economics, we need to devote some time to learn psychology. He is (writings of an author never dies) the pioneer in the field of Behavioural Finance.

Thank you sir for sharing it ..

Indeed! a great personality. I have read his book Thinking fast and slow. In it, the framing effect is one of the phenomenon which i found interesting and highly applicable.

Thank you for sharing your take on the personality.